Gain on Disposal of Fixed Assets

An option on the Fixed assets parameters page lets you turn the locking functionality on or off. Also the disposal of fixed assets account is credited with the agreed value of the item.

Disposal Of Assets Disposal Of Assets Accountingcoach

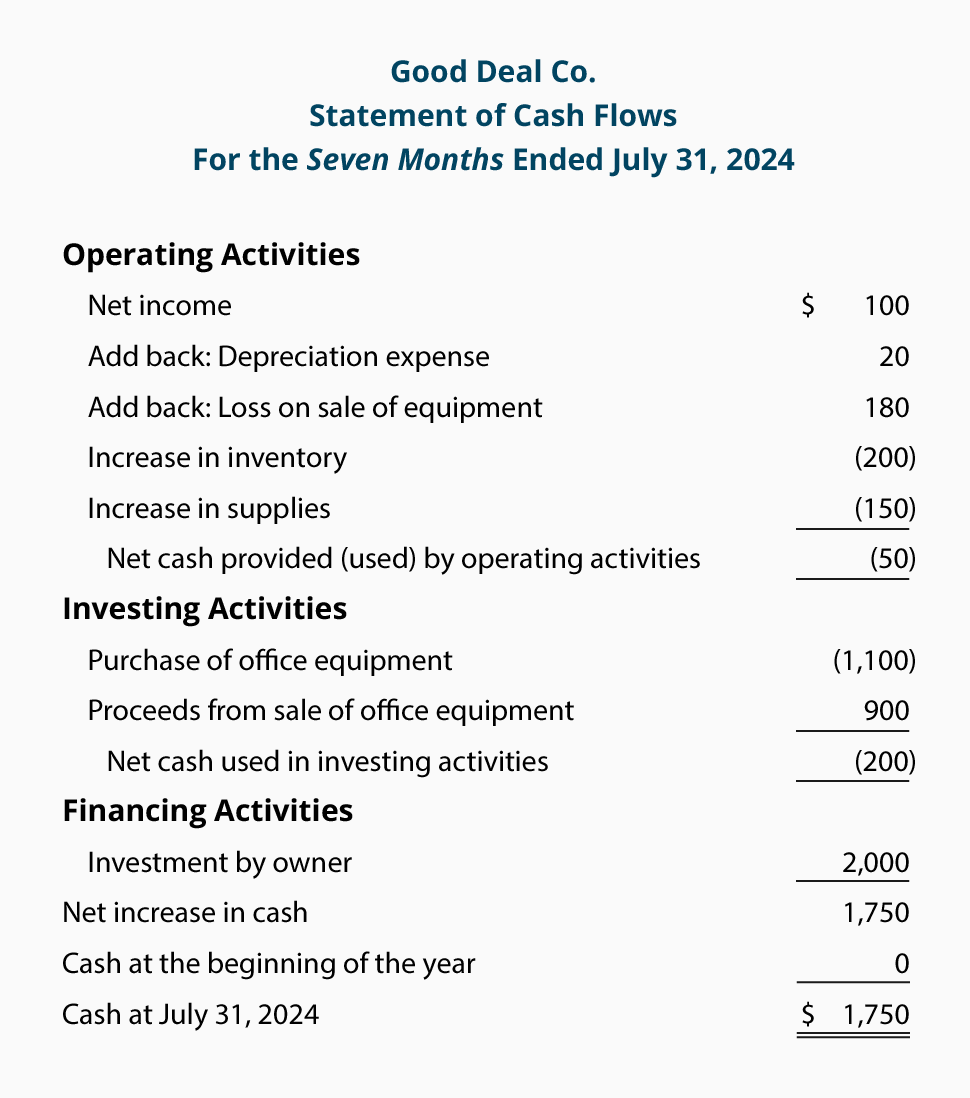

Dividend income and interest income should be classified under investing activities unless in case of for example an investment bank.

. Investing cash flow. The net amounts are then moved to the appropriate account for gain and loss for asset disposal. If carrying value of asset is more than consideration received then it is a loss.

Credit the disposal account if there is a gain on disposal It is also possible to accumulate the offsetting debits and credits associated with the elimination of an asset and related accumulated depreciation as well as any cash received in a temporary disposal account and then transfer the net balance in this account to a gainloss on asset. Removal of income to be presented elsewhere in the cash flow statement eg. For a fuller explanation of journal entries view our.

Clean Harbors has a VGM Score of B. Gain or misfortune is determined as the returns from the liquidation less the conveying measure of the resource. The Xero Cloud Accounting Software allows you to track and manage your business fixed assets to manage their depreciation and disposal.

Asset disposal requires that the asset be removed from the balance sheet. However you need to first set up the assets within Xero and mark them. Asset disposal may require the recording of a gain or loss on the transaction in the reporting period when the disposal occurs.

Unitholders may be entitled to a foreign tax credit for foreign taxes paid by a REIT. Sensible disposal of fixed assets is of sure significance from the viewpoint of keeping a good overall arrangement sheet so the equilibrium of the decent resources is perceived and the aggregated amortization precisely. Fixed asset posting profiles.

For the purposes of this discussion we will. Disposal indicates that the asset will yield no further benefits. The fixed asset disposal scrap transaction changes.

This feature is enabled in the Feature management workspace. Any balancing figure in the disposal account will indicate gain or loss on disposal and this balance will ultimately be closed in profit and loss account. Undo the disposal of an asset.

Select Disposal scrap and then select a fixed asset ID. This refers to the net cash generated from a companys investment-related activities such as investments in securities the purchase of physical assets like equipment or property or the sale of assets. In healthy companies that are actively investing in their businesses this number will often be in the negative.

If youve depreciated the pool for more than one year after the disposal date roll back depreciation before undoing the disposal. There is no upward adjustment. In each case the fixed assets journal entries show the debit and credit account together with a brief narrative.

The capital gain component of a REIT distribution must be included in the unitholders net capital gain calculation. The journal entries of asset disposal is to reverse both the recorded cost of the fixed c. In the Accounting menu select Advanced then click Fixed assets.

Depending on the value of the asset a company may need to record gain or loss for the reporting period during which the asset is disposed. Assume that the entity had an. The disposal of REIT units will have CGT implications.

Under the cost model the carrying value of fixed assets equals their historical cost less accumulated depreciation and accumulated impairment losses. The credit is applied against the Australian tax payable on foreign sourced income. To undo the disposal.

A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a loss on disposal. The fixed assets journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets. These steps are cyclic in nature and most of them happen in any fixed management lifecycle.

In the Accounting menu select Advanced then click Fixed assets. Ance on accounting for fixed assets and corre-sponding depreciation of those assets under GAAP. The exchange of fixed assets refers to one way of fixed assets disposal where one entity agrees to receive a fixed asset in exchange for another companys fixed asset.

A non-current asset and to record the disposal in the non-current asset register. Fixed Assets - Process Flow Fixed Assets is a six-step process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset. Select the Sold Disposed tab.

Accounts and record a gain or loss on its disposal. Click Undo Disposal then click Undo to confirm. Disposal of Fixed Assets Double Entry Example.

Gain on revaluation of investments. It is a well-known environmental service company focusing on waste disposal and recycling. The journal entries for gain or loss on.

After making the above-mentioned entries the disposal of fixed assets account shows a debit or credit balance. Accounting for Disposal of Fixed Assets. To fully dispose of the asset dont enter a value in either the Debit field or the Credit field.

To help guarantee that transactions are correctly reversed. Click Undo Disposal then click. Review the journal and if required select the accounts to use for a gain on disposal capital gain or loss on disposal.

IAS 16 Property Plant and Equipment and IAS 38 Intangible Assets specify two models for subsequent accounting for tangible and intangible fixed assets respectively. Elimination of non cash income eg. Clean Harbors CLH.

If it shows a debit balance this denotes a. The disposal of assets involves eliminating assets from the accounting recordsThis is needed to completely remove all traces of an asset from the balance sheet known as derecognitionAn asset disposal may require the recording of a gain or loss on the transaction in the reporting period when the disposal occurs. Xero Fixed Asset Depreciation.

Typically there are two types of exchange of assets. Clean Harbors has a VGM Score of B. Click the asset number to open the asset details.

Entries for the disposal of a capital asset ie. Then PHAs can debit the cost of the new asset to the proper asset account. A business has fixed assets that originally cost 9000 which have been depreciated by 6000 to the date of disposal.

As mentioned above the exchange of fixed assets may result in gain or loss. It has been prepared for REAC by the accounting firm of PricewaterhouseCoopers. Some people prefer to use QuickBooks for this in which case this Xero vs QuickBooks comparison might come in handy.

To create a disposal journal go to Fixed assets Journal entries Fixed assets journal and then on the Action Pane select Lines. It can be understood more simply in terms of carrying value. ASSESSMENT CRITERIA Record disposals of non-current assets 24 CONTENTS 1 Accounting for the disposal of capital assets 2 Part-exchange of assets 3 Disposals and the non-current asset register.

Select the Sold Disposed tab. Click the asset number to open the asset details.

Disposal Of Assets Disposal Of Assets Accountingcoach

No comments for "Gain on Disposal of Fixed Assets"

Post a Comment